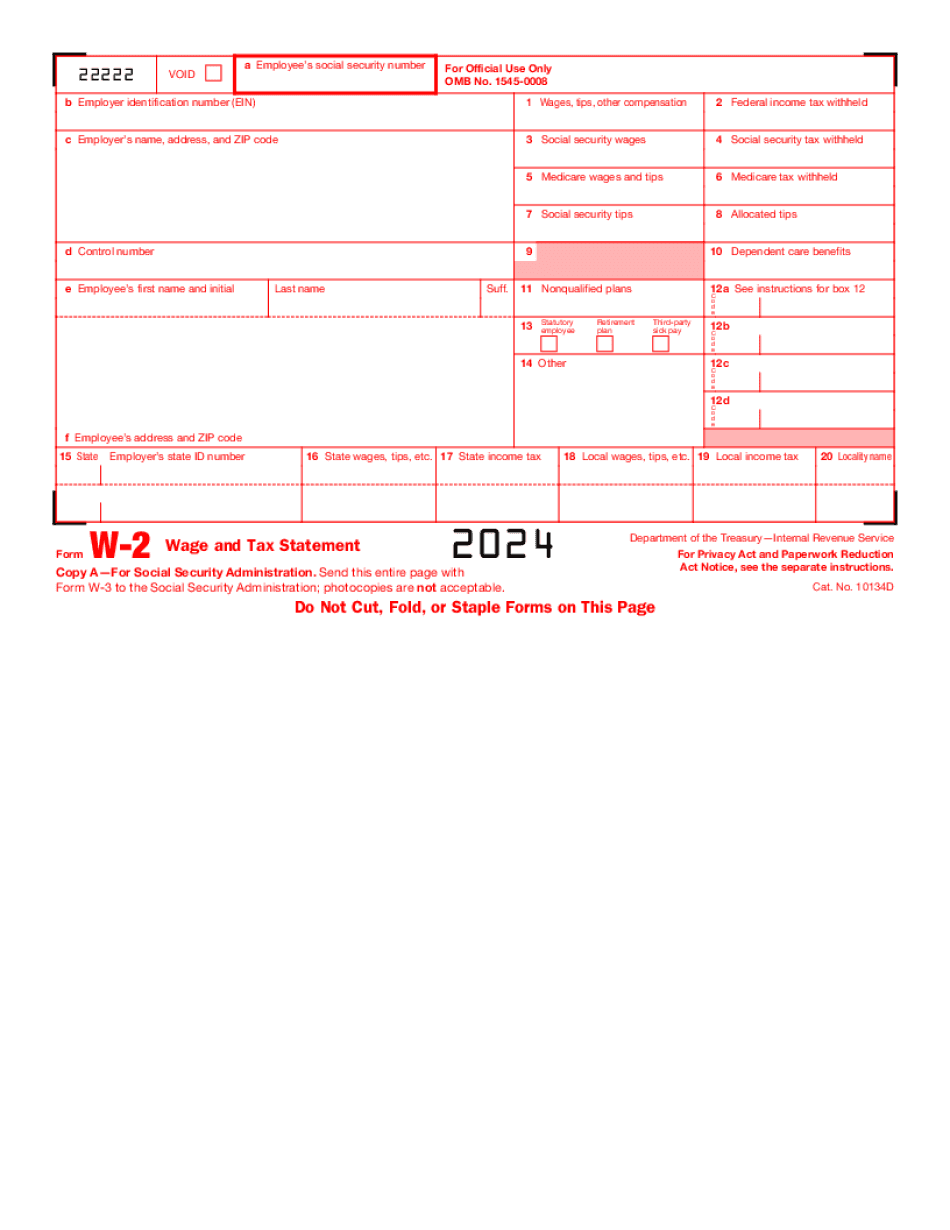

IRS W-2 Tax Form 2024-2025

Show details

Hide details

Ne. See E-filing later. Due dates. By January 31 2019 furnish Copies B C and 2 to each person who was your employee during 2018. Instead you can create and submit them online. See E-filing later. Due dates. By January 31 2019 furnish Copies B C and 2 to each person who was your employee during 2018. Mail or electronically file Copy A of Form s W-2 and W-3 with the SSA by January 31 2019. See the separate instructions. Attention You may file Forms W-2 and W-3 electronically on the SSA s ...

4.5 satisfied · 46 votes

w2form-online.com is not affiliated with IRS

Filling out Form W-2 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form W-2

Every citizen must declare their finances in a timely manner during tax season, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form W-2, our trustworthy and straightforward service is here to help.

Follow the steps below to Form W-2 quickly and accurately:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official instructions (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Complete your document using the Text tool and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or choose Mail by USPS to request postal report delivery.

Choose the best way to Form W-2 and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is W2 Form?

Form W-2 is intended for Wage and Tax Statement. An employer has to fill out the W-2 and further send to employees and the US Department of Revenue. In this form an employer provides detailed information about the amount he paid to employees and deducted taxes. A person should download an appropriate fillable sample form and complete it attentively according to instructions. W-2 has to contain the following information:

- 01personal data of employer and employee (i.e. name, identification code number and address);

- 02details about amounts paid (for instance wage, social security, medicare, income tax etc.).

Further such information is used by an employer when filing form 1040 to the IRS. For convenience, an individual can fill a form template online. After a document is filled out, check all information provided if it is true and correct. A person can easily fill out a printable template online. When e-filing a document make sure all empty boxes are filled in. On this website you can find various free updated PDF samples of this form which further can be easily saved, printed and submitted to a recipient. Save your time and spend just a few minutes to create a legally binding document.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form W-2?

You need to file Form W-2 if your gross income before you took the deduction is 600 or more. You do not need to fill out this form if your gross income for that year is less than 600. To figure your deduction for Form W-2 in a calendar year, you must add up your wages for all the work you do and the amount of money you paid yourself for such work. To determine your allowable deduction on Form W-2, you can subtract the amount of business expenses you claim on Schedule C and a net profit for the prior calendar year. For more information, see Pub. 525.

How do you calculate the taxable part of Form W-2?

Form W-2 gives you a complete description of all the income and expenses you receive during the year. You use the information on the form to calculate what you can exclude from taxable income on Form 1040.

What is considered an income-tax-free zone?

If you receive a deduction for the business-related losses that you report on Form 2555, you do not have an income-tax-free zone. Your business-related losses may be deductible by the business (for example, you may be able to deduct loss amounts up to the amount of any deductible business expenses) but not by you.

How do you determine whether you have an income-tax-free zone?

For the purposes of calculating your deduction, you use information for the prior year as if the taxable income were the same as for the current year.

Note. All amounts deducted for business expenses under the special business expense deduction provisions of section 165 must be apportioned on a quarterly basis. See Pub. 475 for more information. (Back to Contents)

The following rules apply when using Form W-2 to determine your deductible business expenses: The amount of tax that you may deduct from your income for the year is determined by the tax rate that was effective as of the beginning of the tax year. Tax rates are set each year by the Internal Revenue Service. If your income is subject to a tax rate of less than 10%, you do not have a taxable income and thus do not have to follow the rules for claiming a deduction.

Who should complete Form W-2?

Your employer

Do you own or manage a business

You qualify for another deduction. You can use Form W-2 for both nonemployment taxes and employment-related tax. However, there are several caveats.

You can't use Form W-2 for more than three dependents. Your spouse and each dependent must complete Form 1040EZ when claiming the child and dependent deductions.

You must claim your nonemployment tax deduction on Schedule A (Form 1040), even if you are filing an additional return.

What to do if you are filing separately: To claim your nonemployment taxes on your separate return, you must include a Schedule A (Form 1040) with your Form 1040 or Form 1040A.

For Form W-2 and Form 1040A, you may need to attach Form 1040NR, Annual Return — Other Exemptions.

, you may need to attach Form 1040NR, Annual Return — Other Exemptions.

When do I need to complete Form W-2?

You need to file your W-2(s) on the 30th of the month immediately following the end of the tax year. So if you work for a corporation which has an income tax deadline, you must file your W-2(s) by the 15th of the month immediately following the end of the year to ensure you don't miss anything.

Are my W-2(s) due?

Your W-2(s) are due on or before April 15th of each year or on or before the 15th of April of each year for a joint return, or the 15th of April of each year for a separate return.

What if I was not able to figure my W-2(s) on my return form?

If you do not find your W-2(s) on your return form, you may be able to get a free copy of Form W-2(s) (or a copy of a copy of the return if you need to have it recopy-able in case the original is lost or destroyed) by calling the IRS at or completing Form W-2 (Request for Taxpayer Assistance) and mail it to the address listed in the instructions for Form W-2 or call the Form W-2 Web page (). The form can also be downloaded, saved and viewed through an Internet browser (e.g. Internet Explorer).

Can I create my own Form W-2?

Yes. You may create a company with your family. Form W-2 must use a unique identifier (such as the Social Security number), and you should give at least one person in your family complete control of the company. Even if you and your family live in the same household, your Form W-2 is a business record, and you may want to include an authorized representative in the company.

When does the IRS recognize a company under the tax law?

The first thing to remember is that all new companies created after Nov. 15, 2005, get the same tax treatment as your existing company: they must file Schedule C (Form 1065). Form C is the form for companies that are filing a corporate tax return and are using Form 1065 (or 1095) as their company return to report income and distribute payments.

However, if you wish to create an individual corporation you must wait until after 2005 to file Form 1065. If, after your organization has complied with IRS regulations, you wish to incorporate, then you have three options available to you; either an individual or a partnership, or both, as described on the page about creating a corporation.

Individuals and partnerships can have tax-exempt status for as long as they meet IRS definition and do not violate other tax laws such as unfair or deceptive acts and practices. An individual corporation cannot have tax-exempt status but can have exemption or pass-through or unrelated business tax (ATO) tax. For example, shareholders, partners, directors, officers, and employees generally must pay federal income tax on their salaries and profits. The term pass-through is used in the definition to refer to a corporation that is organized and operated as a pass-through entity of another entity. Such an entity pays income, excise, or other taxes on its own profits and pays income tax only on the dividends or other amounts received by the pass-through entity. For the purposes of this publication, a “nonpass-through entity” is generally an entity that has a “pass through” entity. In fact, the IRS generally provides that an individual is not an “individual” under the tax laws if he has a pass-through entity.

If you are forming your own company, the key factor is how the company will be incorporated. If you use Form 1120S to create an established domestic corporation, you generally can elect one of the two rules: the domestic incorporation rules, or the foreign incorporation rules.

What should I do with Form W-2 when it’s complete?

If you are a US resident, you will want to use Form W-2. You and your employer may receive a W-2 that contains a balance due. However, if you are under age 18, you should use Form 1040.

What should I do with a Form 990?

You can request a copy of Form 990 for use in preparing your return. If you are a US resident, you will also need to check out Solo's publications, “8 Ways to Prepare and Present Your Federal Income Tax Return,” and “Equalizing Your Federal Income Tax With Your State and Local Taxes.” Both books are available on Solo's website. In some ways, Solo's books are simpler to follow and understand than the book's author, Kevin L. McPherson, a tax attorney and certified public accountant.

If you are not a US resident and can’t use Form 990 you can use Form 990-EZ (Electronic Federal Tax Return). Both forms are free to use, although you'll need to provide proof of your US mailing address. (Please use form 990-EZ only, not 990.)

If you have questions about the use of a certain form, e-mail your question to the IRS Taxpayer Advocate Service (TAS). If your question is about Form W-2, Form 990S or a Form 990-A, use our Contact Us form.

Related Information

You'll find tax credits and deductions in the IRS Publication 969. Don't forget, you have options to lower the amount of tax you get each year. It takes a little planning to find the most favorable tax rates, particularly when you can’t get the maximum tax credit or deduction.

How do I get my Form W-2?

To check your Form W-2, visit the IRS website at.

For questions about Form W-2 instructions, call the IRS at. Taxpayers with technical questions can always visit the IRS Website at . If you have difficulty accessing our website, please email us at and ask for tax help.

How do I receive Form W-9?

To receive a copy of Form W-9, you must use the Form W-9 or e-mail it to our web page by using the instructions on the Form W-9 instructions page. Do not send a copy of Form W-9 by U.S. Mail. It takes 5-10 days to process your Form W-9 if it is sent to our address. If your Form is sent by U.S. Mail, your tax return must be postmarked by April 30 to be processed. You can track your file status using the Tracking System.

Do I have to file an amended return when I make any correction(s) in my current return(s)?

No. It is not required to file an amended return. You can file an amended return if you believe the information you reported on the prior return(s) was incorrect or incomplete.

Do I have to file a corrected return when I apply a tax deficiency on the prior return(s)?

No. It is not required to file a corrected return. You can file an amended return if you believe the information you reported on the prior return(s) was incorrect or incomplete. If you are filing under the False Claims Act, you must file an amended return with all the information you are submitting at that particular time. You can track your file status using the Tracking System.

Amendments You Made

Can I make changes to my prior tax returns online? How do I change my name and/or address on the previous tax return?

Yes. You can file a new paper return using our online system at. If you are in the IRS service center/Filer Locator, you may use this link:.

What documents do I need to attach to my Form W-2?

You must include an amended or supplemental form with each wage report, but they do not need to be filed online. You can use any electronic or paper copy of this form to send it or sign it, and then use any other methods to send and file your tax return.

If you're an employee and must file with a Social Security number, you must use the W-2 form with your Social Security number unless you signed a separate I-9 to indicate the type of worker who was the payee for the wage check. The W-2 form may be used by employers. For example, if you are an employee, and you have to file a Form W-2 with your employer but pay your employees only wages, you must use that Form W-2 rather than the form for wages.

Are you required to include Form W-2 with your return?

It may be mandatory for employers to include Form W-2 with their income tax returns if the employment relationship was for more than two months but less than one year, and the employee was paid wages for more than one calendar year.

Employment relationships are temporary in nature, but they may end for any reason.

Do I have to fill out a W-2 form if I am an individual who is not an employee?

If you are self-employed or are considered to be so according to the employment tax law, you cannot file a Form W-2 from your business. However, you can complete a Form 2555, Employee's Withholding Allowance Certificate, to report all of your earned income on your individual income tax return.

If you are an employee when you receive a Form W-2 with a payment that is part of an employee benefit plan, you have an election to pay federal income tax on that income only. For more information, see Publication 544.

What documents do I need to prepare a copy of my federal income tax return if I was self-employed (or I have an election to pay federal income tax only)?

Do not include any statements or checks in your return. A check is considered a statement of payment and therefore is not an acceptable document. A statement such as A, Y, W is accepted to report cash payments.

You can create a copy of your return and file it with the federal tax return preparer if you have no federal return to file.

What are the different types of Form W-2?

The types of Forms W-2 include:

Group-Level: Group-level Forms W-2, and individual-level Forms W-2, are filed by companies that are a part of a multi-owner group, i.e., they are registered under the same laws and have common ownership and control. In these cases, employees at the company are listed as “contributors” to the group rather than as individual employees.

Line-Level: Individual level Form W-2, also known as a Schedule C, is a report issued by an employee to report income from wages, salary, tips, and other forms of income.

Line: An employee's contributions to Group-level Forms W-2 and individual-level Forms W-2 are only required to be reported as part of that employee's gross income. Thus, contributions made under Group-level Form W-2 or individual-level Forms W-2 are not subject to tax withholding. These forms are known as “payroll” or “self-employment” Form W-2s.

Payroll: An employee's Form W-2 will show as “Payroll.” This is an individual's contribution report, not a report for employer. An employee's Form W-2 will be issued to them by their employer, who is known as an employer reporting entity, or ERO.

Employer Reporting Entity: An ERO is an entity that files Forms 1097-B, 1097-C, 1098-B, 1099-MISC, 1099-INT, 1140, and 44FF. Employer Reporting Entities, or Eros, file these Forms when they accept a non-cash contribution (payroll) from the employer to pay employee taxes. These Forms are also known as Employer Statements of Contributions for Individual Tax Return and as Employer Tax Statements for Employee Tax Return.

Self-Employment: Another form of Form W-2 (known as a Schedule C-EZ/I-CORE) is an independent contractor's report that shows the employer's contributions to the independent contractor's Form W-2.

How many people fill out Form W-2 each year?

Form W-2 is a record of wages paid to employees who work in a certain location and for the same employer and is a key financial document that the IRS uses to establish whether a firm has a “regular” business relationship. In order for a firm's tax-exempt status to be revoked, the IRS requires that the firm comply with the “fiduciary” standard, which requires that a firm's executive officer are actually able to keep the firm's books in order to prevent unauthorized payments. A failure to provide all this information to the IRS could make the firm ineligible for exempt status.

How often does a firm need to file Form 1099?

Firms must file Form 1099 quarterly with the IRS until they reach the “threshold” level. For non-manufacturing firms in 2010 and 2011, the threshold is 5,000 in sales and 15,000 in net profit and profit before taxes.

Is there a due date for Form W-2?

Form W-2 must be provided to your employer (or their agent) no later than the last day of the calendar month following the month you filed the Form 1040. If the due date falls on a Saturday, Sunday, or legal holiday, your employer should provide Form W-2 by the next business day, generally the next business day after you receive the Form 1040. For example, if you received your Form 1040 late, you do not have to file an amended return to obtain a form W-2.

How and when is a Form W-2 required to be filed?

Generally, you have 20 days from the date you receive all required tax information from the IRS to file a Form W-2. However, if you do not receive the tax information the first time, do not lose any of your 20 days if you make timely and correct corrections on the same day within the 20-day period established by the IRS.

If you are unable to file the required Form W-2 by the deadline due to the filing deadline for Form 1040-ES, you will receive a new return and payment of any overpayment of tax due for the period between the new Form W-2 return and the date you will receive Form 1040-ES.

Can I file Form W-2 for any period in the year?

Form W-2 is required only if you will be paid by your employer more than 100 for any of the following periods:

Payment of employee wages on February 5 (March 1 if employee is filing a joint return) through the 12-month period ending on the 31st day of the calendar year in which payment was made

Employee or employee representative wages paid in calendar year 2010 or 2012 paid by April 15

Employee wages paid by April 15 – April 30

Amounts paid through payroll deduction from an employee's check

Employee or employee representative wages paid to a business in 2013 – August 31

Amounts paid through payroll deduction from a business's check

What kind of income can I claim as an employee?

Amounts described in Section 162(m) of the Internal Revenue Code, such as employee contributions to a 401(k) plan, can also be reported as an employee.

Can I deduct employee contributions to my plan?

You may be able to deduct the contributions to your 401(k) plan if the plan is a qualified plan.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here