Award-winning PDF software

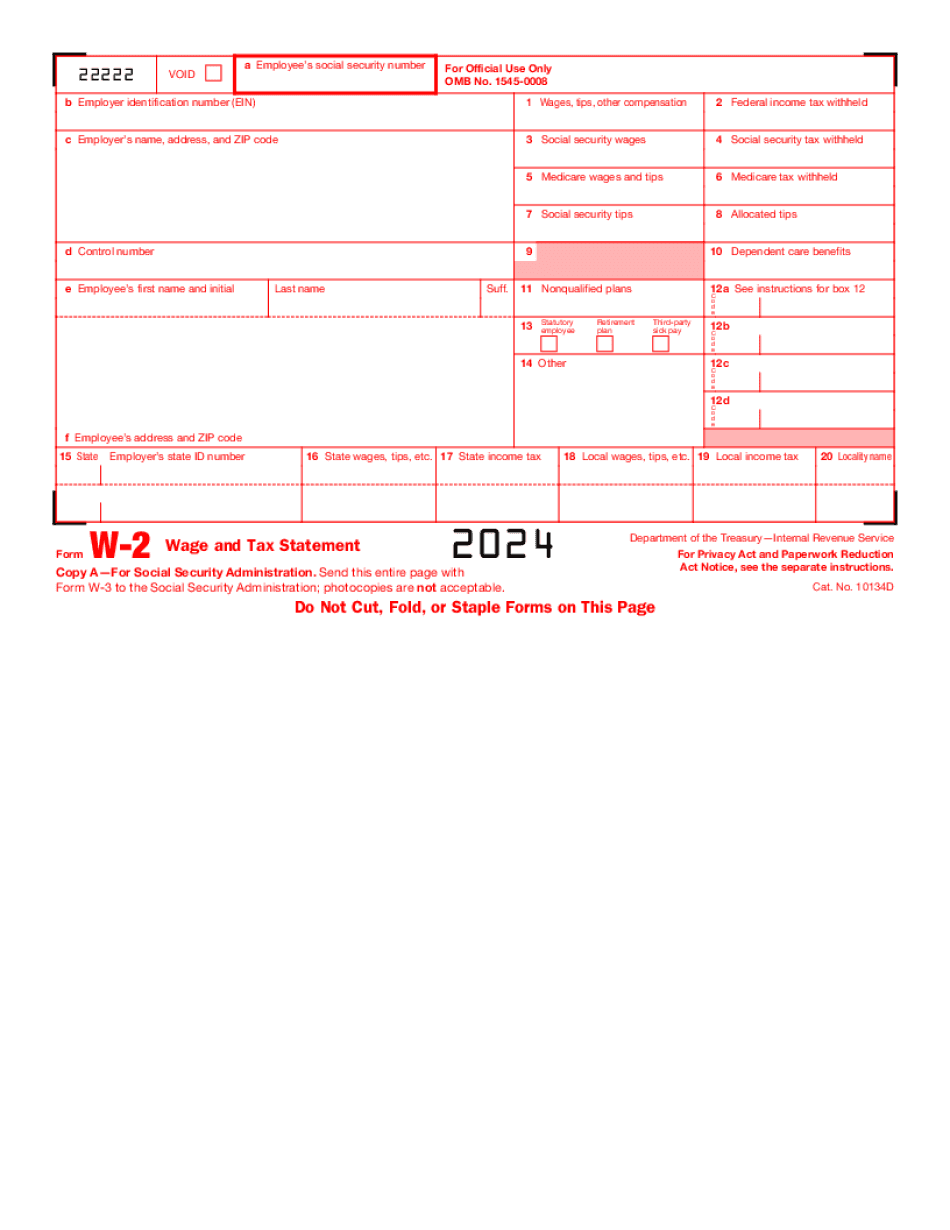

Spokane Valley Washington Form W-2: What You Should Know

Enterprise. For information about how to prepare, file and report this tax please use Form 902 Employer's Statement. About Personal Property Transaction Tax (PPT T) — Spokane County, The County Information about personal property transaction tax. Property tax rate. Property tax registration form. Personal property transaction tax fees. Treaties & Agreements | County, State • Information about Spokane County treaties and agreements. Spokane County Board of Commissioners. Board of County Commissioners. County Commissioners. County-State Treaties and Agreements. County-Local Treaties and Agreements. Washington State Supreme Court. WSU (Treated as a State) Civil Division Washington Department of Conservation (UW). State of Washington. County Assessor's office. Washington Department of Ecology Washington Department of Revenue (FOR). City of Spokane, Spokane County, Washington, United States of America. Property Tax Bills • Washington State Property Tax Bill. Property Tax Bill and Tax Payment Plan Property Tax Bills & Payment Plans • Spokane County Property Tax (Bill) and its associated payment plan. Frequently Asked Questions for Spokane County Property Taxes Tax Calculator • Property Tax Calculator. • Property Tax Bill Calculator. • Property Tax payment plan calculator. How long does it take to do a Property Tax bill? This depends on the type of property and whether it is exempt and what the tax is. Generally speaking, it can take between two and five business days after a property is assessed, at most, for a Spokane County tax bill to be sent. There are, however, some exclusions to this time frame. What are some examples of excluded items? Excluded items are items that are a part of your business, or are necessary for your business to function. Examples include business equipment and certain supplies and materials. However, any item or accessory which is required for your business to operate will be considered an excluded item. Exempt: Business Equipment Exempt: Business Furniture, Equipment & Supplies What is the Spokane County tax rate? The Spokane County tax rate currently is 9.0%. However, the Spokane County assessor determines the appropriate levy level, or tax rate for a property, based on the property's assessed value, the property's tax rate, and other factors. Typically, this process takes time. If you have questions or concerns about the amount that your property will be assessed for a local property tax bill, see the Tax Calculator below.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Spokane Valley Washington Form W-2, keep away from glitches and furnish it inside a timely method:

How to complete a Spokane Valley Washington Form W-2?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Spokane Valley Washington Form W-2 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Spokane Valley Washington Form W-2 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.