Award-winning PDF software

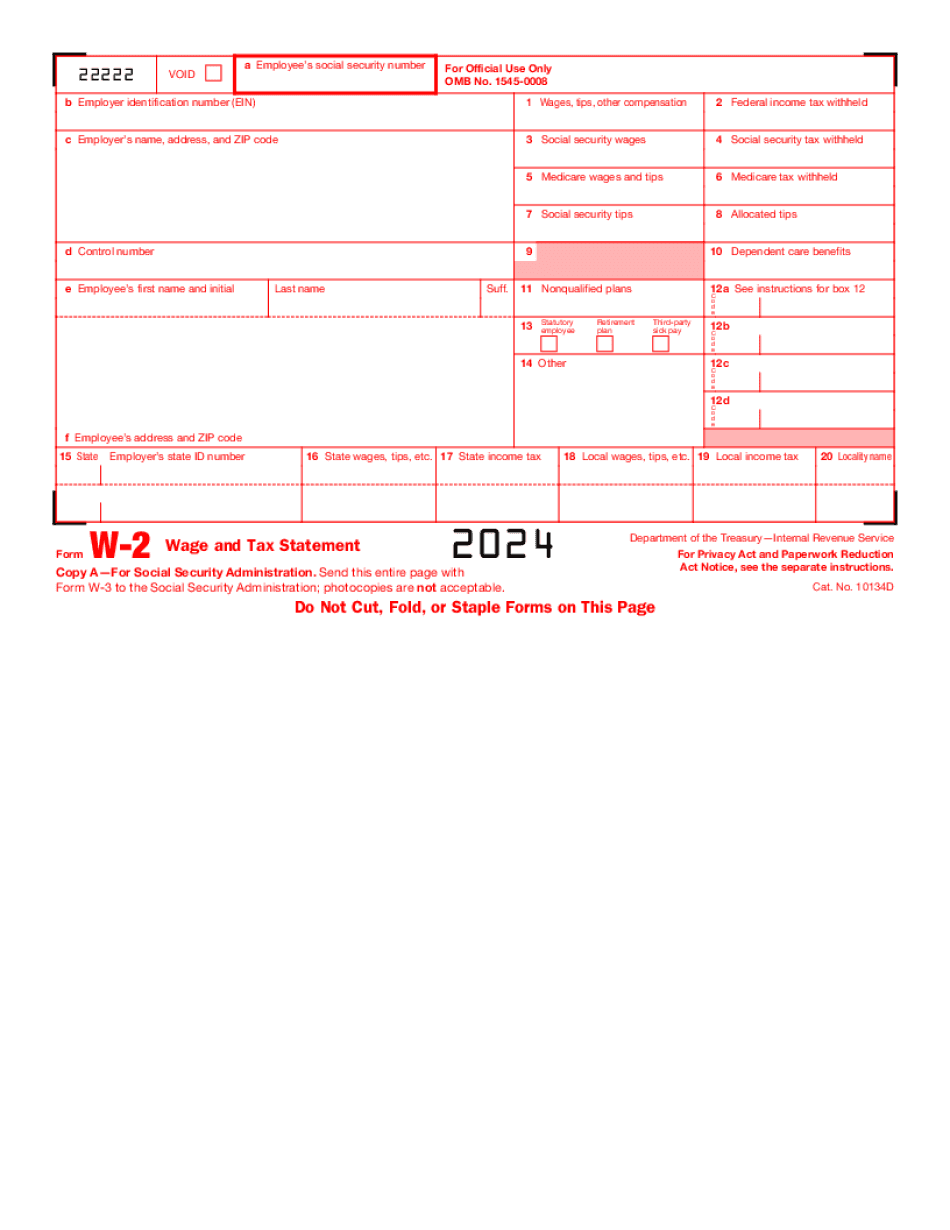

Printable Form W-2 Vallejo California: What You Should Know

Federal employment or withholding tax amounts may be reported from the 2025 tax year onwards. See the instructions on Form W-2 for a list of employment taxes withheld and paid during 2018. For example, for federal taxes withheld using an EIN, see EIN-EZ: W-2 Wage and Tax Statement and Payroll Taxes with Form W-2. You may use Form W-2 to determine payment of taxes; however, you must file the form to receive the final due amount. Frequently Asked Questions (FAQs) for Form W-2 Q: Do I need a State, County, or City Form W-2? A: Yes. You must send a Form W-2 to your local, state, or federal government agency, or anyone or more designated persons. You also may send a Form W-2 for your own use to a state, county, or city government agency, or anyone or more designated persons. Q: Why am I still required to give my employer my W-2 with my wages, tips and other payments of my wages? A: To avoid any doubt or misunderstanding, the law requires that the employer report the information on the W-2 without making any deduction of or withholding from a payer's wages. All Form W-2 payers are required to withhold an amount equal to 3.00% on their wages, tips and other payments. Q: Why can't I change any information on my Form W-2? A: Your employer must maintain accurate wages, tips, and other payments on his or her Form W-2 for each pay period. Q: Why is my filing status still “Independent”? A: Your wages, tips and other payments of your wages are still considered to be paid on an “independent contractor” basis if the contract has no requirements or restrictions that require you to be registered as an agent of an employer. However, these payments include tips and bonuses paid to your employees that are not required to be paid as wages, but that are subject to tax as compensation. Q: Can the employer withhold overpaid Social Security, Medicare, and Railroad Retirement Tax penalties and accumulated FICA taxes and overpayments on my Form W-2? A: No. An employer cannot withhold taxes for taxes not withheld, and employees are required to report the failure to withhold taxes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-2 Vallejo California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-2 Vallejo California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-2 Vallejo California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-2 Vallejo California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.