Award-winning PDF software

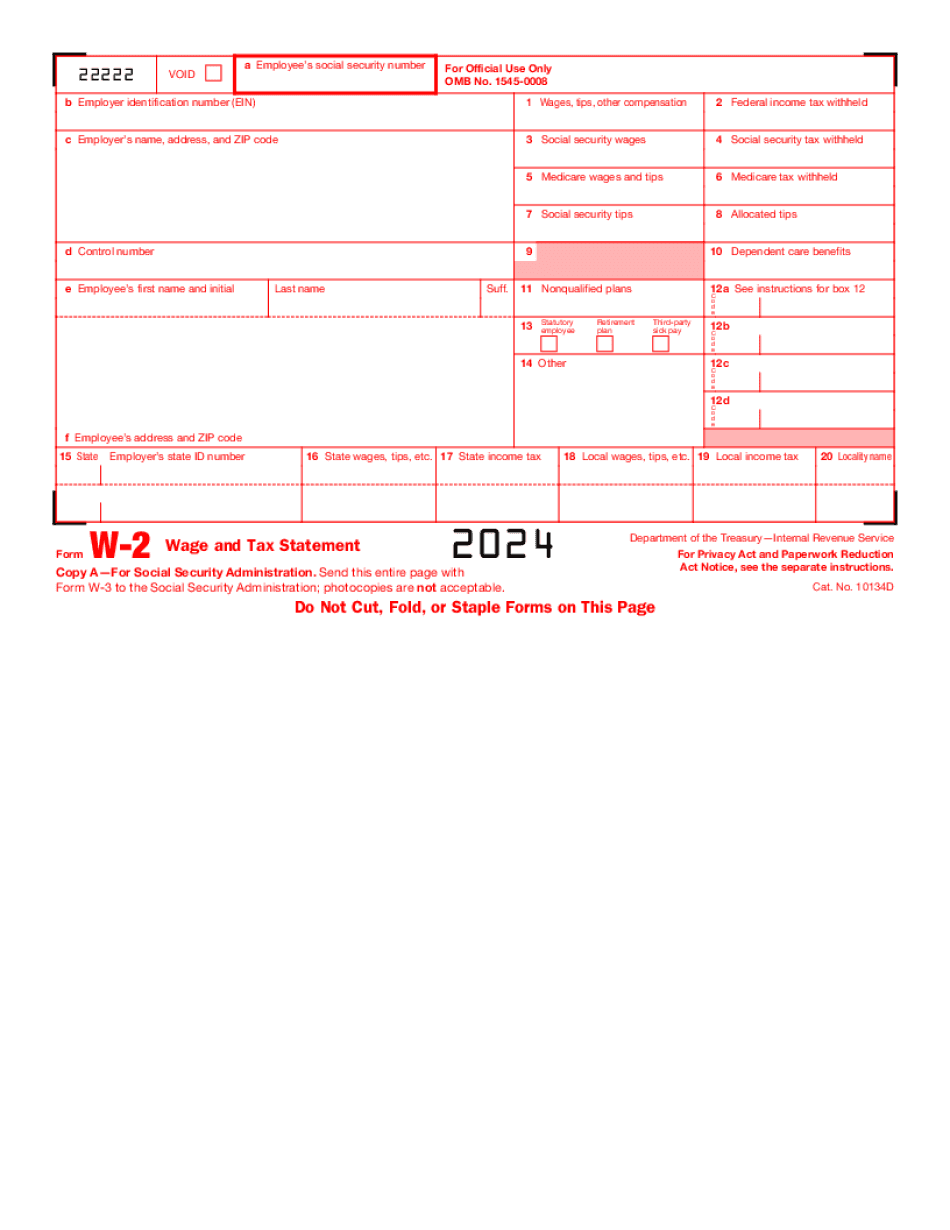

Printable Form W-2 Broken Arrow Oklahoma: What You Should Know

Automatic Billing E-File your Taxes Easily with TurboT ax — FREE To learn more, contact IRS. The Electronic Federal Tax Payment System, commonly abbreviated FTPS is an online electronic payment system. TurboT ax is the fastest growing tax system in the country with more than 3 million users. Taxpayers can electronically pay their taxes online with TurboT ax and the IRS can receive the information. FTPS is designed to make it quick and easy to pay your tax bill. For the complete list of products available to you, including the latest products, please visit IRS.gov. You may also check out an updated list of IRS e-file products found ate file.IRS.gov Electronic Payment System Software: — TurboT ax — TaxA ct Software — Free File — Free Fireplug — Free File Desktop — Free File Mobile — Free File Server Electronic Tax Payment System (FTPS) is a secure online electronic payment system. Federal, state, and local governments use the system. Taxpayers do not need to leave the home or office to complete their taxes. FTPS enables taxpayers to pay their taxes through banks, merchants, and their smartphones. For the complete list of FTPS software, please visit IRS.gov. You may also check out an updated list of IRS e-file products found ate file.IRS.gov. Electronic payments can be processed in seconds through the IRS-certified payment gateway at MyChoiceTax.gov. To help taxpayers navigate and pay at MyChoiceTax.gov, all tax products are labeled along two major tax payment paths, including FTPS payment options. Payments can also be made with the IRS Mobile application. IRS offers a number of tax payment solutions including the Free File, Free File Mobile, and Free File Server, which supports most file types like the 1040EZ, Schedule C, SSA Form 1040 and many others. Form W-2 for federal income taxes: Use form W-2 for federal income taxes You may use Form W-2 for federal income taxes; this form may be used for filing any state and local taxes. A Form W-2 should not be submitted for any other taxes, such as the property tax or rental interest tax. For more information, call a tax professional.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-2 Broken Arrow Oklahoma, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-2 Broken Arrow Oklahoma?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-2 Broken Arrow Oklahoma aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-2 Broken Arrow Oklahoma from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.