Award-winning PDF software

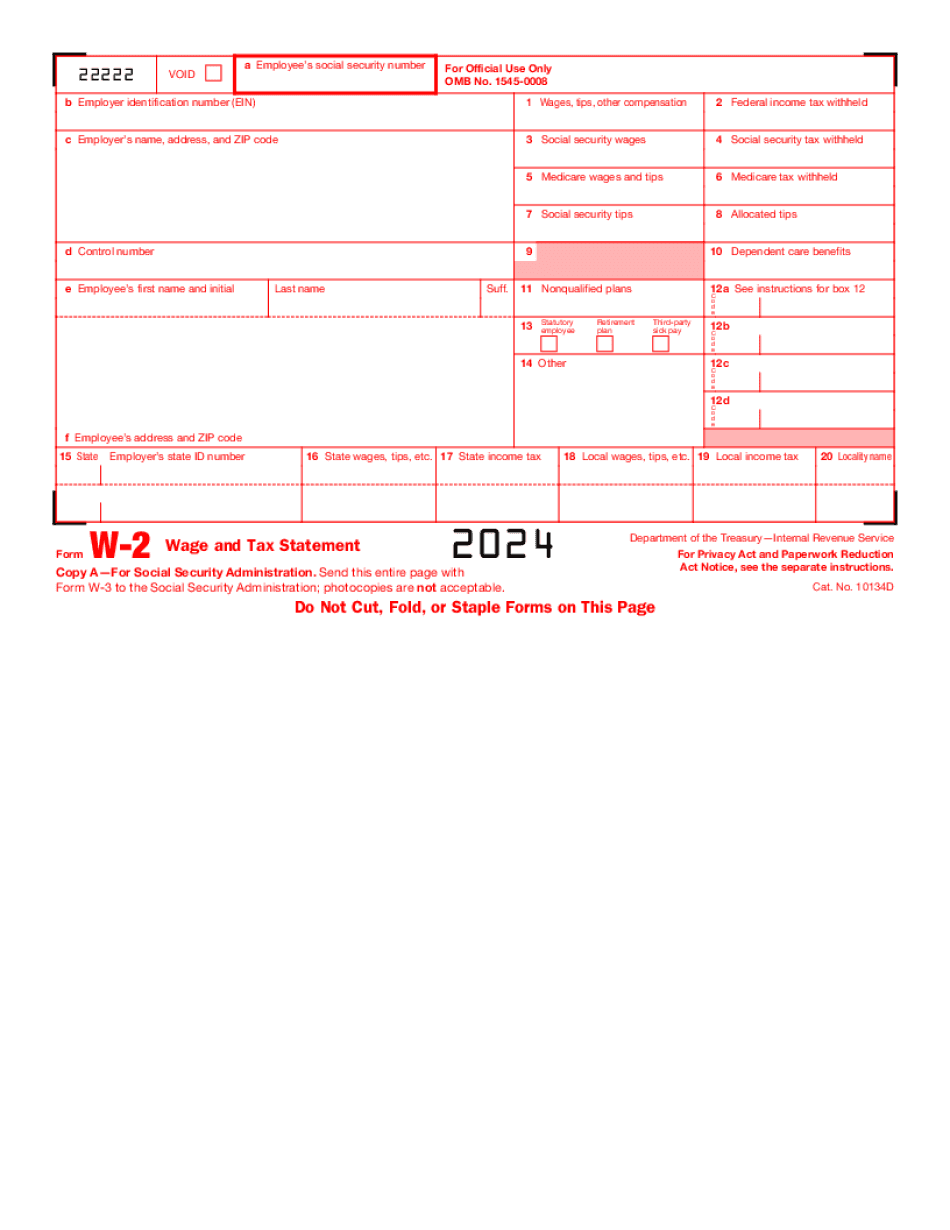

Concord California Form W-2: What You Should Know

The SCO will prepare the W-2 (and will send your personal information to us when you submit it), but will not process the W-2 until you've submitted the following personal information: your Social Security Number; date of birth; gender; race or ethnicity; and marital status. 3. Your employer is required to report your wages (W-2) and any amounts withheld from your wages to the local Office of the Tax Collector, located inside the California State Capitol. 4. The tax is based on your personal income, as shown on your W-2, and your filing status, which can be either single or family. 5. If you have an Employer Identification Number (EIN), you should report that number to the Tax Collector when you submit your W-2 for processing. 6. All employers in Concord must register with the Tax Collector's Office. The fee to register is 50 per business. For more information about Registration | Concord, CA Transient Occupancy Tax (TOT) — Concord, CA (1) Any person as to whom, or any occupancy as to which, it is beyond the power of the city to impose the tax; (2) Any federal or state officer or (3) Employees in the following programs: California State University Concord; California State University East Bay; California State University Northridge; California State University Pomona; California State University Sacramento; California State University San Diego. Building Division | Concord, CA (1) Any person who operates a residence for rent or occupancy as an apartment or housing. (2) Any federal or state officer or employee. Building Division | Concord, CA (1) Any person who is employed to do work (including work on a farm, ranch or other nonresidential enterprise) for the resident rent-paying tenant, or is employed to do work (including work on a farm, ranch, or other nonresidential enterprise) for the resident owner, or a member of the first family, or has a business related to the residence, and the residence is leased or rented to the resident. (2) Any federal or state officer or employee. Building Division | Concord, CA (1) Any person who operates a dwelling house for rent as an apartment or housing. (2) Any federal or state officer or employee.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Concord California Form W-2, keep away from glitches and furnish it inside a timely method:

How to complete a Concord California Form W-2?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Concord California Form W-2 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Concord California Form W-2 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.