Award-winning PDF software

About form w-2, wage and tax statement | internal revenue service

And Change in Employer Filing General Business, General Personal, Family and Dependent, Pension, Employment, Government, IRA, Partner, Other Forms, Related, Related Forms Additional Forms Tax Basics, W-2 Income.

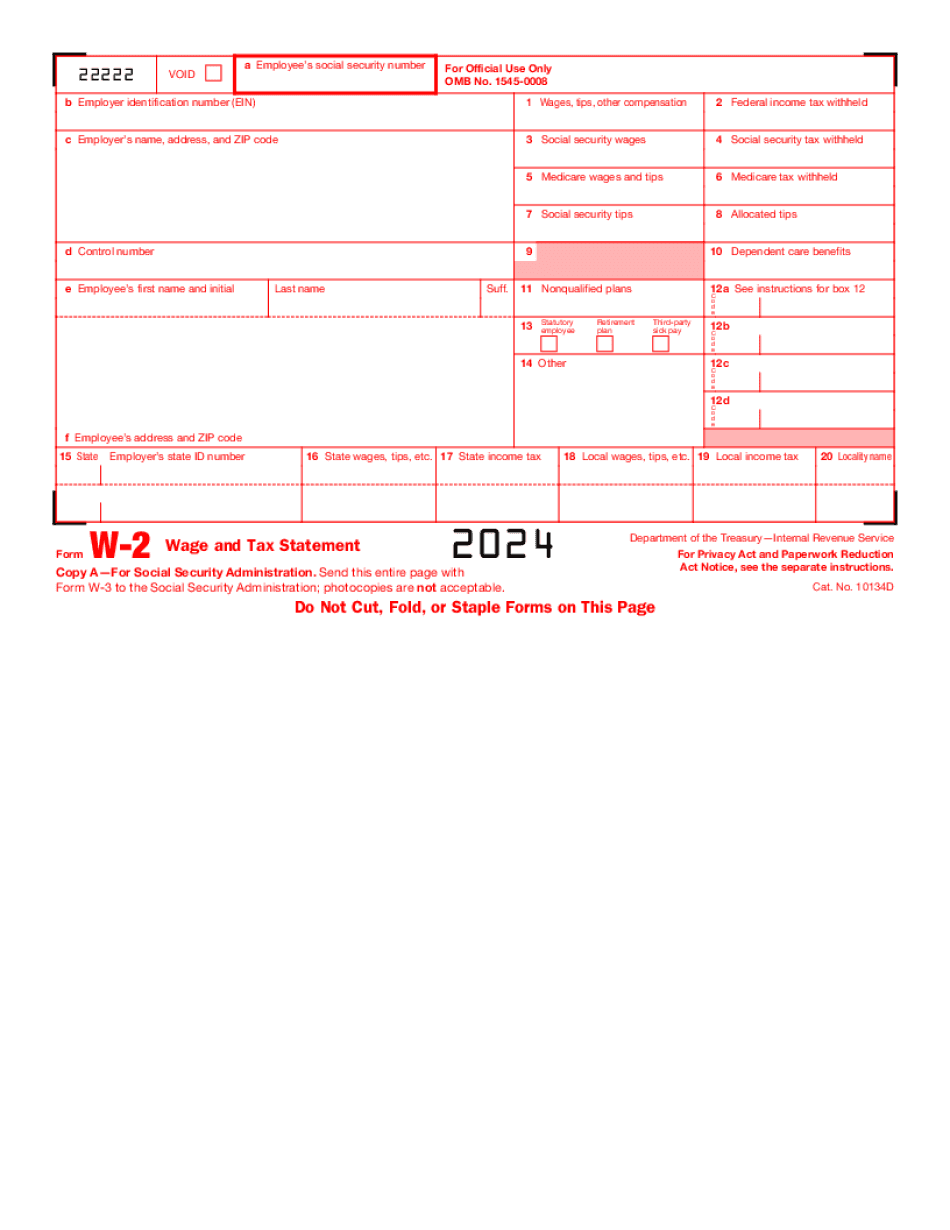

Form w-2

IRC I'm getting pretty sick of the whole “not to ask any questions about private sexual affairs” thing, so I figured I'd just add a note for those wanting me to explain the “why it's not wrong for a guy to kiss his wife while she's in the middle of having a bowel movement” thing from a male perspective: The first reason is that you're not going the extra mile to prove your point, and the whole “oh he's just a friend, he's too cheap to spend 10K/yr” kind of reasoning only appeals to people who haven't had any real experience with real life and want to use the world as a place to talk and not a place to act. So the second reason is that the entire premise of this argument is false. It's not wrong for a guy to kiss his wife while she's having a.

attention: - internal revenue service

To print a completed Form W-2 from this site, visit the W-2 Instructions and Information page. Forms W-3 and W-4 must be filed by telephone, fax, or mailed, if filing electronically. In addition, you may file Forms W-2 or W-3 and W-4 for the last calendar month, but not the current calendar month. For information about filing on paper, go to the Forms SSA-1, SSA-2, and SSA-3 pages. The amount of Federal tax withheld from your W-2 wages is reduced by the amount of Federal income tax that you paid on such wages. If your net earnings from self-employment for the calendar year were 1 million or more, you must file Form 1040NR and Form 1040NR-EZ with your FAFSA or SAVE. Refer to the Instructions for Form 1040NR for more information on these reports. The Social Security administration (SSA) collects and uses your Form 1040NR and Form 1040NR-EZ, as well as any.

What is a w-2 form?

A W-2 can include information about and ?, such as the amount you earned from ?, ?, and related industries. ? W-2 is used to classify employees and other taxpayers according to the amount(s) of income, taxes withheld or paid on ?, ?., and related industries the employee's income relates to ??, the ? Occupation, or ? Position. To see an example of ?, see Example 1. ? W-2 is used to identify what types of employers you're related to. If the employees' W-2 forms are incomplete, you may need to find the address associated with each employer to get the W-2, such as a business, employment agency, financial institution or other business location. What are the important dates for the employer? There are several dates that you need to know if your employer is still using the W-2 tax form. If your employer still uses the form, find out when the form was.

Form w-2: wage and tax statement - investopedia

Last edited by SickSickLoser Posted by: Anonymous Reply With Quote But if you did not actually work as many hours in the past year, you're not even earning any income. What that means is this: you have to pay for the past year and still have to take out money to cover the wages for 2. If you get paid by the hour, then you have only worked the minimum amount required to earn that amount in the past year. Otherwise, your earnings will be credited to your tax. So that means the more hours you put in, the larger the refund you will qualify for. And of course, more hours means more tax if you're paying taxes to start with. I know it sucks, but it's the truth. And don't your W-2 is not a tax return. Posted by: Anonymous Reply With Quote. As a general rule, a W-2 is.