Award-winning PDF software

Make A Free W-2 Form - Formswift: What You Should Know

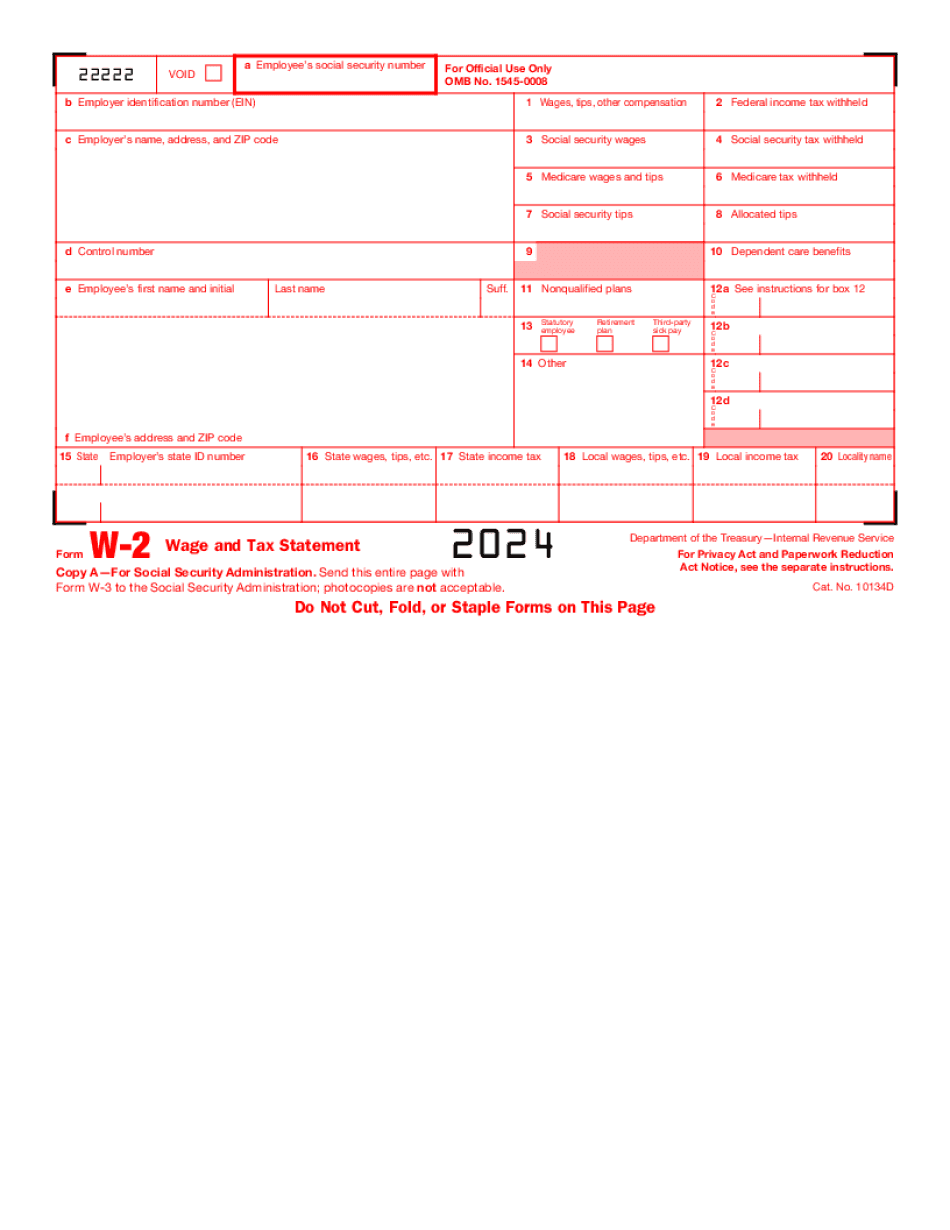

The basic form (Form W-2) is a single-page, single-sided, single-sided form used by most employers to report their employees' wages for tax reporting purposes. Use a complete, single-sided, double-sided, and all-pencil format; if you prefer, use the double-sided version to accommodate a larger number of employees. The W-2 form is a required document for most employees who work in the United States. Employers can use this form to pay wages at the end of each pay period (monthly or quarterly), pay benefits (including employer-paid vacation, sick pay, and insurance), or report the employee's share of social security, Medicare, and other federal and state income taxes. You should print out and take a printout of the tax form for all employees. It gives the employer the information they need to make tax payments to the Internal Revenue Service. The standard W-2 form begins as follows: Form W-2 — Wage and Tax Statement You may fill it out yourself, but in the event that you need an assistance to complete it, you may want to request an. Copy from a Social Security Administration (SSA)-approved Instructions for use Instructions for use and how many copies you should use You may order by phone or e-mail. Send a completed, completed, and signed copy of the .doc format W-2 to the Social Security Administration. More Forms — IRS You may not complete all the information on W-2 form, but at least the employer and the employee should have the required information. If you are a U.S. resident, you can mail the form to a Social Security Administration (SSA) office outside the United States. If you are not a United States citizen, resident, or eligible noncitizen then you must complete and file your own .doc format W-2 on the employer's W-2 return. Use the W-2 form to make the following types of payments: Income tax payments to a designated government agency. Benefit payments or payments for retirement, disability, or death to a qualified plan or to an employee retirement plan (including an IRA or pension). To determine your U.S.

Online choices help you to to prepare your doc administration and supercharge the productiveness of your workflow. Follow the fast guide for you to full Make a Free W-2 Form - FormSwift, keep away from glitches and furnish it in the well timed fashion:

How to accomplish a Make a Free W-2 Form - FormSwift over the internet:

- On the web site together with the type, click on Begin Now and pass into the editor.

- Use the clues to fill out the pertinent fields.

- Include your individual facts and phone knowledge.

- Make certain you enter proper data and figures in acceptable fields.

- Carefully verify the content on the variety in the process as grammar and spelling.

- Refer to aid section if you have any thoughts or deal with our Assist team.

- Put an electronic signature in your Make a Free W-2 Form - FormSwift while using the assistance of Sign Resource.

- Once the shape is accomplished, press Carried out.

- Distribute the prepared sort by using email or fax, print it out or help you save on your machine.

PDF editor makes it possible for you to make changes to the Make a Free W-2 Form - FormSwift from any online connected equipment, customise it in keeping with your needs, indicator it electronically and distribute in numerous methods.