Music hi everybody, welcome back to my channel. I am back with another video today, and since I've been doing a little research while I've been taking a little time off, I've noticed that there are the same old jobs hiring right now, not anything really new that I haven't already discussed on my channel. So, I decided that this would be a good time to do an informational video about Texas and being an independent contractor. You know, when you do all these side hustles and stuff, you are an independent contractor, and a lot of people want more information about Texas and how you go about paying your taxes and everything like that. I'm also gonna show you guys a demo of how you can try to estimate how much your taxes are gonna be, and how much you may have to pay in self-employment tax. I am NOT a tax professional, so I'm not gonna get into any heavy tax jargon or anything like that. I am just a regular person who has been an independent contractor for several years. I do my own taxes, and I've never had any trouble, and I pay my taxes every year. So, I'm just gonna keep this as simple as possible for you guys. Let's go ahead and get straight into it. When you work from home or do side hustles most of the time, you are going to be an independent contractor. Even with certain work from home jobs, you can be an independent contractor or an employee. An employee is gonna receive a W-2, but an independent contractor is gonna receive a 1099. As an independent contractor, you are in business for yourself. If you are a business owner or contractor who provides services to other businesses, then...

Award-winning PDF software

1099 vs W2 calculator Form: What You Should Know

If you are paying self-employment taxes in 2025 and have been assigned a pay rate on this form, please use this calculator to calculate your taxes for this year. The IRS is constantly working to get more accurate tax brackets and rates for independent contractors. If you have more questions please read about the IRS 1099 form and the IRS 1099 tax calculator. Check out our blog to learn lots more about self-employment taxes. Pay Taxes In The Freezer This Tax Season If you are using a 1099 from your employer to prepare your taxes, the best way to ensure that you are paying the correct income tax and withholding on your wages is to file any taxes that your employer sends in the form of a 1099. You have four business tax return forms you can use for free this year. You are considered to be a “freezer company,” and you do not have to report your wages or withhold income on the 1099 from your employer. In 2017, the IRS increased the threshold for qualifying as a freezer company to 1 million in adjusted gross income. So just like before when filing a regular tax return, you can file a 1099 to report your 2025 wages in February. These 1099 will have your employer's information listed. And you are not supposed to report any of those wages from 2025 on your 2025 tax return. And it means that you can start paying your tax liability in February if you have your paycheck from your employer scheduled at that time for payment in February. It means that this is an easy way to have paid taxes already paid and waiting for you in February for the next tax season. Click here to start using our free 1099 tax preparer today! Are your 1099s ready yet? I had no idea how to file a 1099 with my business tax return as I was trying out using this tax calculator. But I was able to get it done easily and with no hassle.

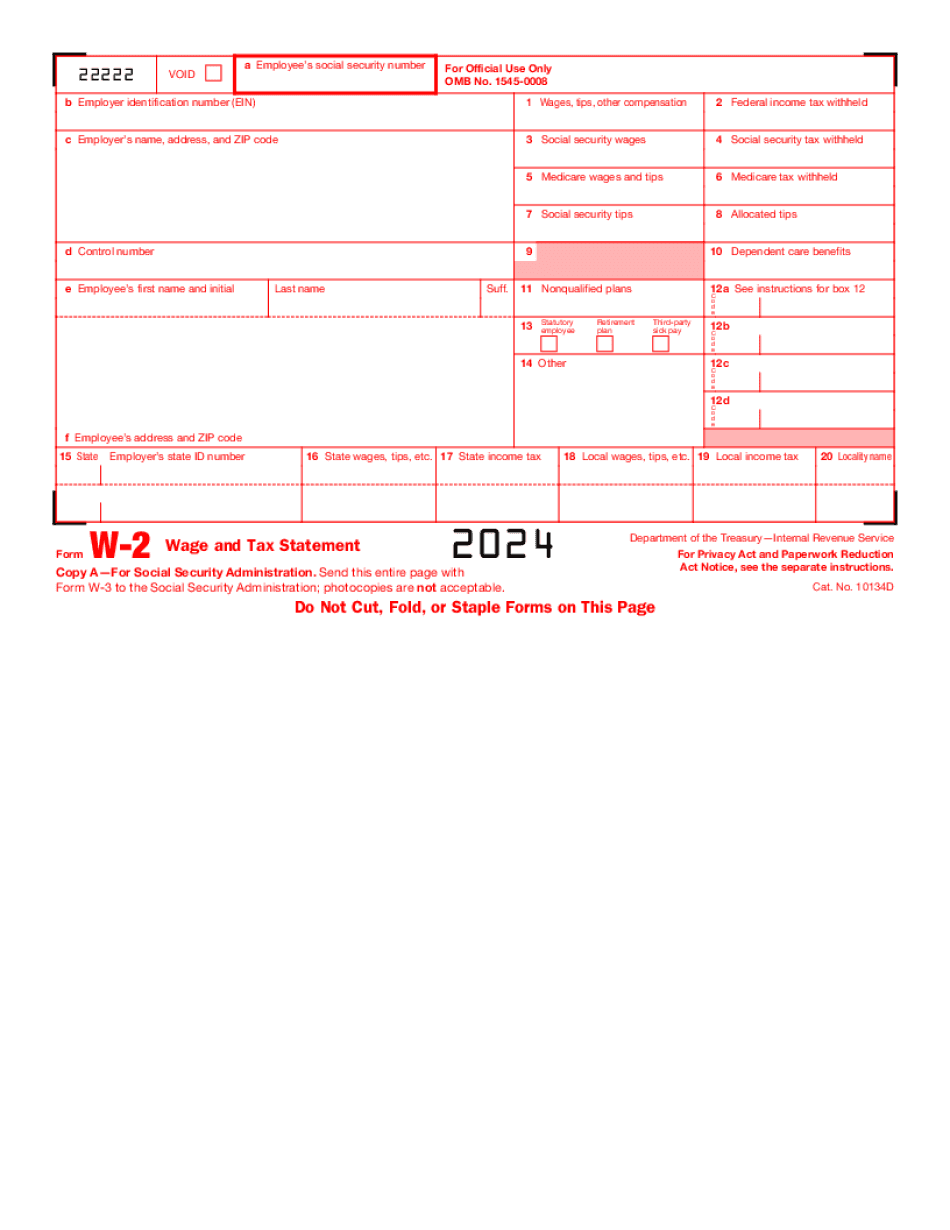

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 vs W2 calculator