I'm here with Dijon from Out. Isn't telling you guys have had thousands of jobs run through your company over the last 2025 years, right? Right. Tell me about some of the legal stuff I need to know. First, what is a 1099? A 1099 is somebody that, at the end of the year, gets a 1099 from the company they worked for, meaning they're truly an independent contractor and there are no taxes being taken out of the check that is being sent to them. Okay, that sounds good. I like to know taxes, power, right? Again, I'm fresh to this country, and I'm not clear on a 1099 versus a W-2. What is a W-2 and how is it different, or is it the same thing? Well, the W-2 is your record employer. So if you work for someone, let's say you're a 9-to-5 person, you're gonna get a W-2 at the end of the year from your employer. Okay. As a freelancer, though, you can also receive a W-2 depending on your relationship with your client. Okay, cool. So once more, for freelance, and once more for full-time, yeah? And the W-2 is when taxes are taken out of your paycheck. Okay, so how do I know if I'm a 1099 employee? How do I know if I need a 1099 form? Well, if you don't know what a 1099 is, you really shouldn't go down that path. So, however, to get a 1099 from a company, you truly want to be an independent contractor, meaning that you have your own business, you have your own clients, and you're not really relying on one particular client to give you the income for your year. Okay, I've heard something like it's sort of like the 80/20 rule. If...

Award-winning PDF software

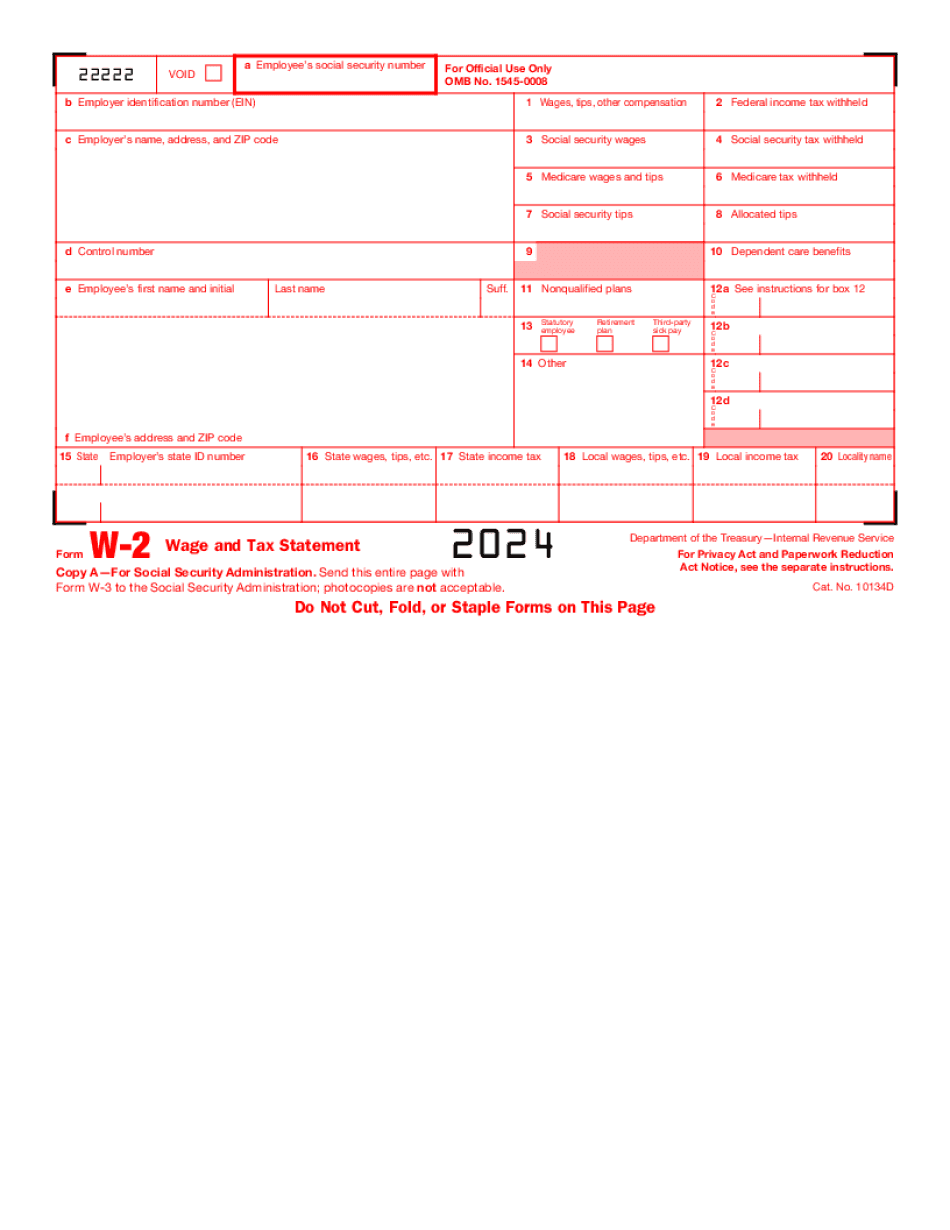

1099 or W2 which is better for employee Form: What You Should Know

Employers usually use 1099s as a lower cost alternative to full W-2 status, but are you more than a freelancer? 5 key areas of difference between 1099s and W-2s.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 or W2 which is better for employee